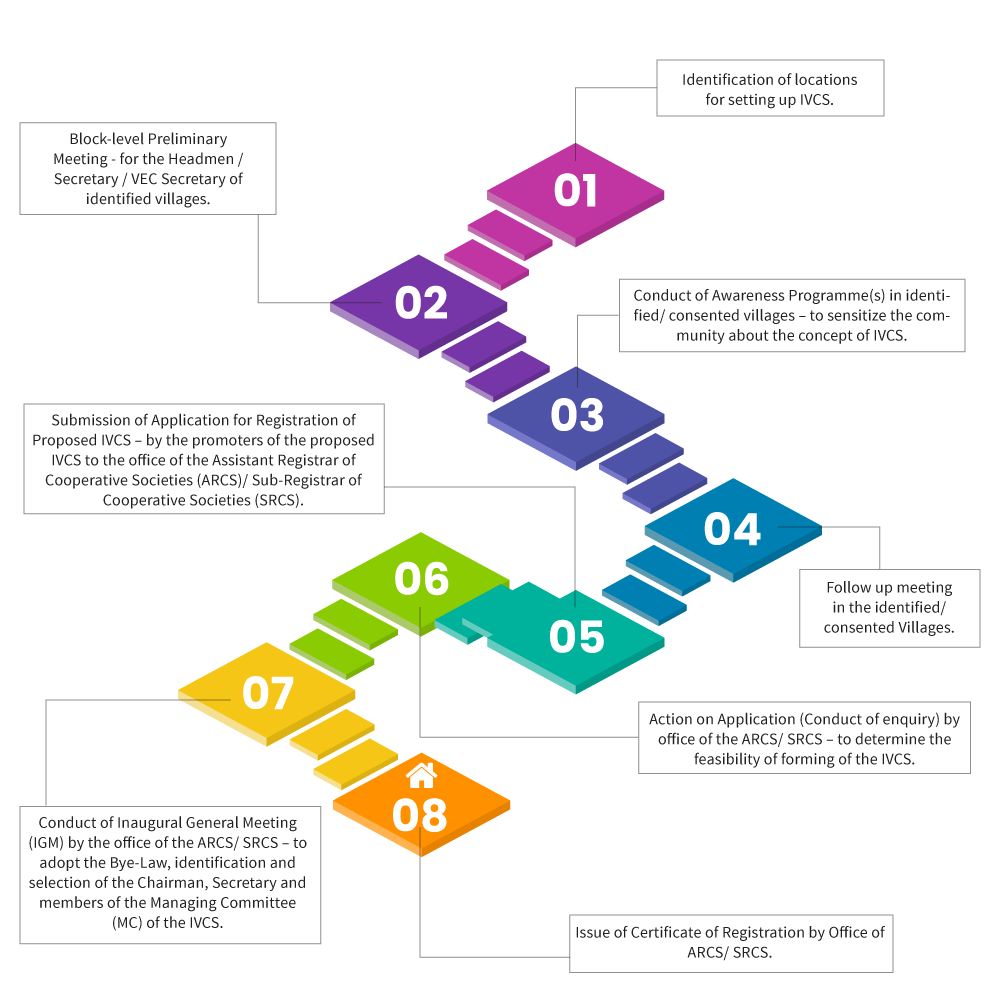

The IVCS is formed by residents of a single village, ideally having 200 households. A main village along with 2-3 adjacent villages can also form an IVCS. A minimum of 15 adults can initiate, as promoters, the process of formation. Membership is open to anyone above the age of 18, provided they live in the village(s) covered by the IVCS. Affairs are managed by a Managing Committee, which comprises of 10 select members. The project has established 300 IVCS across 11 Blocks of the state to legally carry out financial activities and provide thrift, credit and other financial services to the people. The process for formation is as below:

Rural Finance Key Interventions

FORMATION OF IVCS

Capacity Building

Capacity building measures, trainings and handholding support are at the core of the IVCS initiative right at the outset. Since inception, trainings have included BIRD Lucknow conducting an orientation programme on IVCS for members of the IVCS Core Team, Roll-Out programmes for senior officials of the Cooperation Department, GoM, Meghalaya Cooperative Apex Bank (MCAB), District Project Managers, DPMUs MBDA/MBMA, officials of FSD, MBMA, orientation programmes on IVCS for Nodal Officers, DPMUs, Block Development Officers (BDOs) and newly formed IVCS, training programmes on Maintenance of books, registers, etc., training programmes on operations, preparation of Business Plans and Action Plans, and Financial Literacy Programmes in the IVCS.

Business Planning

A Training Programme/ Micro Workshop on Preparation of Business Plans and Action Plan for IVCS are being conducted for IVCS at the Block level. The training uses an excel template on which each IVCS can plot their respective numbers which would help the IVCS to determine the most preferred combination of activities which would result in the IVCS making profit over a period of time. Master Trainers will, in turn, conduct Training Programmes/ Workshops on Business Planning at the Districts/ Blocks for the other IVCS. At the end of the workshops the participating IVCS would have a business plan and an action plan for implementation. Initially, during preparation of the Business Plans, the IVCS will give priority for Thrift and Credit operations while other economic activities may be taken up at a later period. The business plans will focus on viability and sustainability of the IVCS.

Support to IVCS

The Project envisages contribution to the IVCS as under:

Corpus fund of Rs.2,50,000/- per IVCS.

Support Fund of Rs.1.50 lakhs for acquiring Office equipment & Furniture, which also includes computer, Fireproof Safe , etc.

Viability Gap Funding.

Risk Fund

Books, Registers, Ledgers, Pass Books etc.

Financial Literacy Programmes in the IVCS

Financial Literacy Programmes (FLP) are being conducted for all the residents (members and non-members of IVCS) of the village by the Financial Literacy Facilitators (FLFs). The FLFs are identified and selected from amongst the members of the IVCS and trained by the Master Trainers from RF on the subject. IEC materials, translated into Khasi and Garo languages, relating to the programmes are customised and printed locally and distributed to all IVCS. Taking into consideration that the residents of the villages have to attend to their livelihood activities during the day, the FLPs are coonducted mostly in the morning and evening over a period of 5 to 6 days in batches of 20 to 40. These programmes are expected to benefit 90,000 participants over a period of 6 months.